The global chip shortage is now impacting DDR5 manufacturing

In brief: If you're currently using a quality DDR4-3200 retentiveness kit, going with DDR5 for your next upgrade won't yield much of a performance comeback despite its significantly higher price. Not only that, finding DDR5 modules in stock will be a struggle in the coming months equally manufacturers can't go their easily on some essential components needed to make them.

Early on adopters of Intel's Alder Lake platform take to choose between DDR4 and DDR5 when purchasing an LGA 1700 motherboard, but at that place are ii things that make that choice easier than y'all call back. As noted in our reviews, regardless of whether yous want to use a Core i5-12600K, Core i7-12700KF, or a Cadre i9-12900K, going with DDD5 over DDR4 won't bring you any worthwhile performance uplift for almost tasks, especially when yous take into consideration the price premium you accept to pay for the newer memory modules.

Interestingly, even if you lot are willing to pay a hefty price for a DDR5 memory kit, chances are y'all won't be able to notice one in stock no matter how hard y'all wait. This is somewhat expected when it comes to new hardware, and peculiarly in the context of an ongoing chip shortage that has made it virtually impossible for companies to meet the surging demand for a multifariousness of consumer electronics.

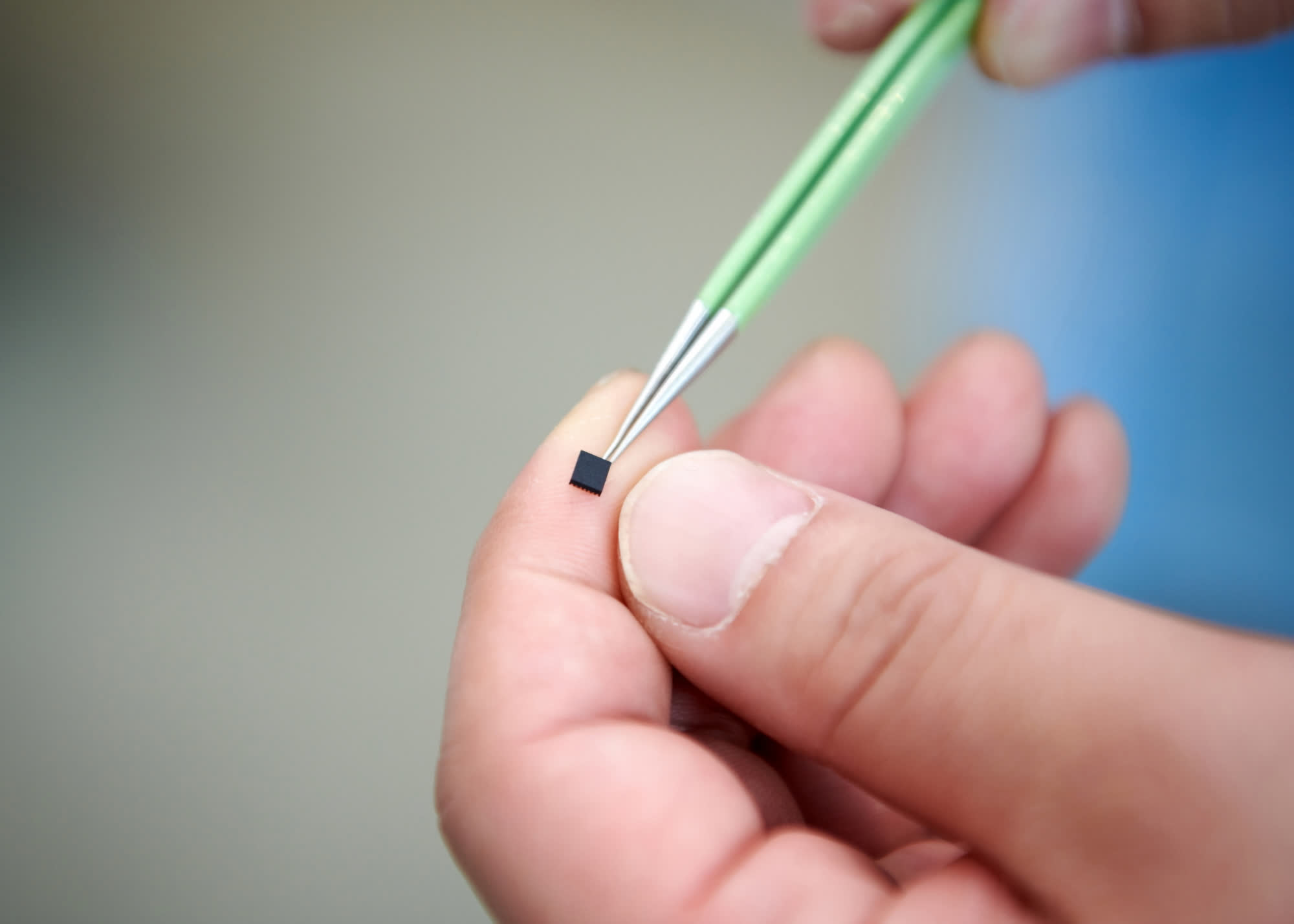

According to a report from electronic component supplier 12chip, the scarcity of DDR5 memory modules isn't rooted in a shortage of DDR5 chips. That'due south partly considering DDR5 chips are manufactured using an older 14nm process node, and DRAM suppliers haven't reported any problems in keeping upwards with demand.

The problem is that unlike DDR4, DDR5 modules integrate a power direction integrated excursion (PMIC) that used to be part of the motherboard. The PMIC needed for DDR5 is not only much more expensive than that used for DDR4, but it's also in curt supply, with procurement fourth dimension now estimated at 35 weeks.

Earlier this yr, some analysts predicted that DDR5 would overtake DDR4 in terms of market share by 2023, but that seems highly unlikely given the electric current supply concatenation problems. On a more positive notation, the chip shortage has given smaller chipmakers an unexpected heave, allowing them to more than easily invest in expanding their product capacity. At least in theory, they should be able to meliorate the availability of PMICs and other essential components in the coming years.

Source: https://www.techspot.com/news/92281-global-chip-shortage-now-impacting-ddr5-manufacturing.html

Posted by: longprajectow.blogspot.com

0 Response to "The global chip shortage is now impacting DDR5 manufacturing"

Post a Comment